Fueling Growth,

Securing Returns

Better

Bigger

Faster

EquiBridge is a dynamic portfolio focused on investing in SME IPO-bound companies. Our approach combines a unique mix of equity and debt investments designed to drive growth while targeting substantial returns at the time of the IPO.

Empowering IPO Success

Equity & Debt Flexibility

Co-Investing Strategy

Disciplined Selection

High Expected Returns

Why Choose EquiBridge?

Targeting High-Growth SMEs

We focus on profitable SMEs with IPOs expected within the next 18 months. This maximises growth potential while minimising investment risks.

Flexible Investment Strategy

We employ a combination of equity and debt investments tailored to each company’s specific growth stage, ensuring optimal alignment with market dynamics.

High Return Potential

By targeting companies with strong fundamentals, we aim for a 50% return on IPOs, offering significant rewards for investors.

SME IPO Boom

Investor appetite for SME stocks surged due to high returns.

New relaxed rules by SEBI, BSE and NSE have boosted investor confidence.

The number of SME IPOs surged from 59 in 2021 to 182 in 2023.

Government’s support encouraging SMEs to pursue IPOs.

Going public allows SMEs to raise critical capital.

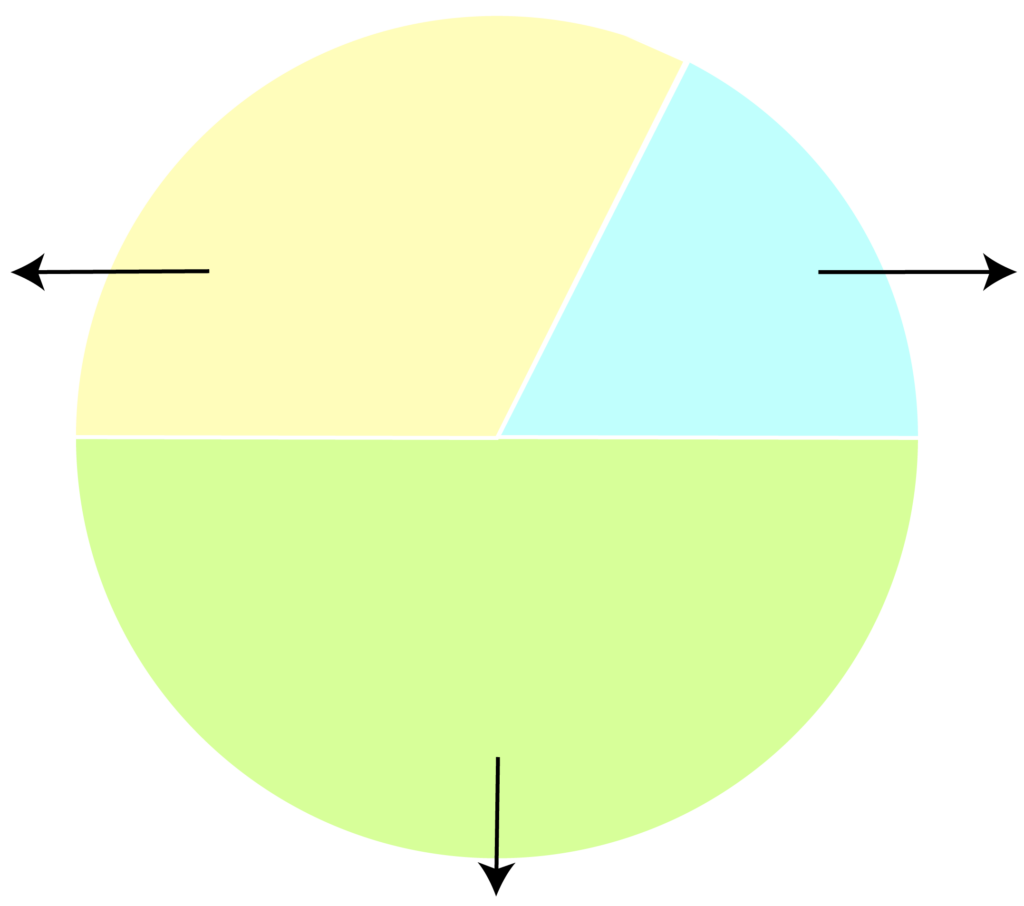

Strategic Portfolio Allocation

Debt & Revenue-Based Financing (30%)

30% of our investments focus on flexible debt and revenue-based financing (RBF) structures, ensuring predictable income streams.

- SME IPO Bound

- Debt/RBF

- Startups

SME IPO-bound Companies

(50%)

50% of the fund is allocated to profitable SMEs with IPOs expected within 18 months, aiming for high returns at IPO.

Early-Stage Startups

(20%)

We allocate 20% of our fund to high-growth potential startups, providing exposure to innovative business models.

Consistent quarterly payouts provide steady returns throughout the fund’s life, while exits ensure full

capital recovery and maximum profit realization for investors

Our Leadership Team

Value Proposition

Targeting Profitable SMEs

Equity and Debt

Investments

Co-Investing for Risk Minimization

Disciplined Selection Process

Targeting Profitable

SMEs

We invest in SMEs expecting IPOs within the next 18 months, focusing on companies with strong fundamentals and growth potential.

Equity and Debt

Investments

Our flexible investment strategy allows us to invest in both equity and debt, optimising returns based on each company's stage of growth.

Co-Investing for Risk Minimization

We co-invest with strategic partners, committing up to 20% of the portfolio to minimize investment risks and maximize returns.

Disciplined Selection

Process

We target companies with a Price-to-Earnings (P/E) ratio of 20 or less, ensuring value-driven investments and growth potential.

Value Proposition

Targeting Profitable

SMEs

We invest in SMEs expecting IPOs within the next 18 months, focusing on companies with strong fundamentals and growth potential.

Equity and Debt

Investments

Our flexible investment strategy allows us to invest in both equity and debt, optimising returns based on each company's stage of growth.

Co-Investing for Risk Minimization

We co-invest with strategic partners, committing up to 20% of the portfolio to minimize investment risks and maximize returns.

Disciplined Selection

Process

We target companies with a Price-to-Earnings (P/E) ratio of 20 or less, ensuring value-driven investments and growth potential.

Join EquiBridge and be part of a new wave of growth in the SME sector. We are committed to creating value for both companies and investors, ensuring a future of prosperity and success.

Reach Out to Us

Ready to Invest?

Join EquiBridge and be part of a new wave of growth in the SME sector. We are committed to creating value for both companies and investors, ensuring a future of prosperity and success.

Reach Out to Us

Ready to Invest?

Join EquiBridge and be part of a new wave of growth in the SME sector. We are committed to creating value for both companies and investors, ensuring a future of prosperity and success.